Bank liquidity: The deficit widens by 14%

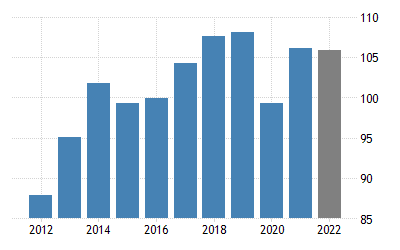

The bank liquidity deficit widened by 14% to stand at -105.4 billion dirhams (MMDH) from February 9 to 15, indicates BMCE Capital Global Research (BKGR).

The continued widening of the bank liquidity deficit is mainly explained by the contraction of nearly 10 billion dirhams in 7-day advances from the Central Bank, BKGR specifies in its recent note "Fixed Income Weekly".

For its part, the Treasury has significantly increased the level of its investments, which show a maximum daily outstanding amount of 43.3 billion dirhams, against 20.8 billion dirhams in the previous period, adds the same source.

For its part, the weighted average rate (TMP) stabilized at 2.51%, while the MONIA (Editor's note, Moroccan Overnight Index Average: overnight benchmark monetary index, calculated on the basis of repo transactions delivered with treasury bills as collateral) fell to 2.421%.

Regarding the outlook, BKGR analysts believe that Bank Al-Maghrib should increase its intervention on the Money Market with the injection of only 44.1 billion dirhams in the form of 7-day advances against 34 billion dirhams the previous week. Read More…