Bad loans pile up at state banks, eating away profits

The banking sector in Bangladesh has been facing a major challenge in recent years due to the mounting bad loans at state banks. The issue of bad loans has been a persistent problem in Bangladesh's banking sector, and it has been plaguing the country's economy for quite some time. The situation has worsened as the pandemic has hit the global economy, making it even more challenging for the country's banking sector to manage the bad loan crisis.

In this article, we will discuss the issue of bad loans in Bangladesh's banking sector, the reasons behind the piling up of bad loans, and their impact on the economy. We will also explore the steps taken by the government and the banking sector to address the issue of bad loans and their effectiveness.

The Issue of Bad Loans in Bangladesh

What are Bad Loans?

Bad loans, also known as non-performing loans (NPLs), are loans that are not being paid back by borrowers. In other words, they are loans where the borrowers have defaulted on their payments or are unable to repay their loans on time.

Why are Bad Loans a Problem?

The piling up of bad loans is a major problem for any banking sector as it can lead to several negative consequences. First, it can erode the profits of the banks, making them less profitable. Second, it can weaken the financial stability of the banks, making them vulnerable to bankruptcy. Finally, it can lead to a credit crunch, making it difficult for businesses and individuals to obtain loans.

Bangladesh Bad Loans Pile Up at State Banks, Eating Away Profits

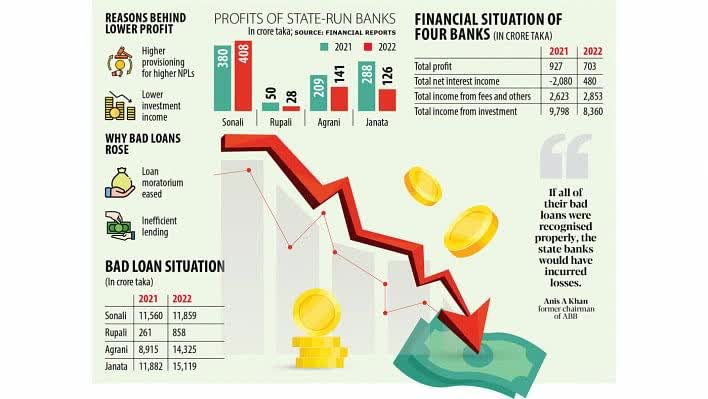

The issue of bad loans has been particularly acute in Bangladesh's state-owned banks. According to a report by the Bangladesh Bank, the central bank of Bangladesh, the amount of bad loans in the country's banking sector reached BDT 1113.68 billion (USD 13.12 billion) as of December 2020. Of this, BDT 778.68 billion (USD 9.17 billion) was held by state-owned banks, which is about 70% of the total bad loans in the country.

The situation has been worsening for state-owned banks, as their bad loans have been piling up over the years. In the 2019-20 fiscal year, the state-owned banks had written off BDT 45.62 billion (USD 537.08 million) in bad loans, which was 25% higher than the previous fiscal year.

The piling up of bad loans has been eating away the profits of state-owned banks in Bangladesh. According to the latest financial reports, state-owned banks have been reporting losses for several consecutive quarters due to the mounting bad loans. For example, in the 2020-21 fiscal year, the six state-owned banks reported a combined loss of BDT 63.77 billion (USD 751.49 million).

Reasons Behind the Piling Up of Bad Loans

Lack of Proper Due Diligence

One of the main reasons behind the piling up of bad loans in Bangladesh's banking sector is the lack of proper due diligence by the banks. Banks often provide loans without proper background checks, which can lead to borrowers defaulting on their payments.

Political Interference

Another reason behind the piling up of bad loans is political interference. In Bangladesh, political interference in the banking sector is a common practice, which often leads to loans being given to politically connected individuals or businesses that are not creditworthy.

Economic Slowdown

The economic slowdown caused by the pandemic has also contributed to the piling up of bad loans. Many businesses have been struggling to pay back their loans due to the economic downturn, which has led to an increase in the number of bankruptcy.

Impact of Bad Loans on the Economy

The piling up of bad loans in Bangladesh's banking sector has had a significant impact on the economy. First, it has weakened the financial stability of the banks, making them less able to provide loans to businesses and individuals. This, in turn, has contributed to a credit crunch, which has hampered economic growth.

Second, the piling up of bad loans has eroded the profits of state-owned banks, which has led to a reduction in their lending capacity. This has had a negative impact on the country's infrastructure development, as state-owned banks are major sources of funding for development projects.

Third, the issue of bad loans has also had an impact on the country's balance of payments. The government has had to allocate a significant amount of resources to address the bad loan crisis, which has put pressure on the country's foreign exchange reserves.

Steps Taken to Address the Issue of Bad Loans

The government and the banking sector have taken several steps to address the issue of bad loans in Bangladesh. Some of these steps include:

Strengthening the Regulatory Framework

The Bangladesh Bank has taken steps to strengthen the regulatory framework for the banking sector. This includes implementing stricter regulations on loan classification, provisioning, and write-offs. The central bank has also increased the capital adequacy requirements for banks, which has made them more financially stable.

Debt Recovery Tribunals

The government has set up debt recovery tribunals to help banks recover bad loans. These tribunals are tasked with expediting the legal process for debt recovery, which has helped banks recover some of their bad loans.

Recapitalization of Banks

The government has also injected capital into state-owned banks to help them address their bad loan crisis. In 2020, the government allocated BDT 50 billion (USD 589 million) for the recapitalization of state-owned banks.

Effectiveness of the Steps Taken

While the steps taken by the government and the banking sector to address the issue of bad loans in Bangladesh are commendable, their effectiveness is still in question. Despite the regulatory reforms and recapitalization efforts, the bad loan crisis in the country's banking sector has not abated.

One of the major reasons for this is the lack of political will to address the issue. Political interference in the banking sector remains a significant problem in Bangladesh, and it is hindering the effectiveness of the steps taken to address the bad loan crisis.

FAQs

1. What are bad loans?

Bad loans, also known as non-performing loans (NPLs), are loans that are not being paid back by borrowers.

2. Why are bad loans a problem?

The piling up of bad loans is a major problem for any banking sector as it can lead to several negative consequences. First, it can erode the profits of the banks, making them less profitable. Second, it can weaken the financial stability of the banks, making them vulnerable to bankruptcy. Finally, it can lead to a credit crunch, making it difficult for businesses and individuals to obtain loans.

3. How have bad loans impacted Bangladesh's economy?

The piling up of bad loans in Bangladesh's banking sector has weakened the financial stability of the banks, hampered economic growth, and put pressure on the country's foreign exchange reserves.