Bitcoin Spikes After CPI Data. But Cryptos Are Still Feeling Regulatory Pressures.

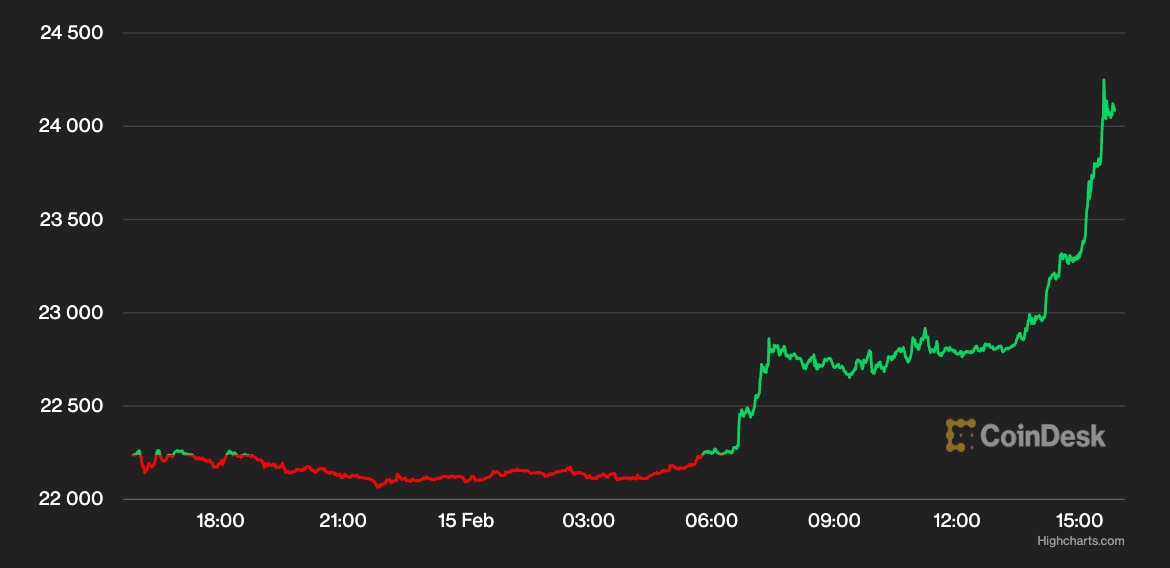

The price of Bitcoin has risen 2% over the past 24 hours to near $22,100, remaining below the zone around $23,000 that had marked the largest digital asset’s trading range for weeks until a selloff last week. Bitcoin is still near its lowest level since mid-January after paring gains from a rally that had seen prices jump 40% from the start of the year.

New regulatory uncertainties have arisen as the latest threat to cryptos, with the Securities and Exchange Commission turning its attention to multiple crypto exchanges and companies across the industry. Products and services in the digital asset ecosystem—including staking, which is critical to the Ethereum blockchain, and stablecoins pegged to the dollar—have come under scrutiny and look vulnerable.

“Cryptos are weakening as every trader worries about how crippling this SEC wave will be with the cracking down on staking products and stablecoins,” said Edward Moya, an analyst at broker Oanda. “The news flow has been rather bearish for crypto.”

Traders are contending with the ongoing regulatory developments with key macro data doing little to change the picture, though Tuesday’s CPI data provided a catalyst for a bit of a boost. A tough macro backdrop of high inflation and rising interest rates has made cryptos and stocks closely correlated.

Investors wanted to see inflation continuing to trend downward, easing pressure off the Federal Reserve as the central bank fights against the hottest price increases in decades. The Fed aggressively tightened financial conditions over the past year in a bid to tame inflation, which was the driving force behind the 2022 market selloff. CPI rose 6.4% in January, slightly above economists’ expectations in a release that was a bit of a mixed bag, but still down from 6.5% in December.

“There happens to be some yo-yoing within a tight range after the data’s release, but no obvious catalysts for Bitcoin to regain $23,000 or sink back towards $20,000 just yet. The market will carry on for the moment,” said Michael Safai, managing partner at crypto fund Dexterity Capital. “It could very well be that inflation data and Fed meetings won’t have the same push-pull effect on crypto prices that they did in 2022, because regulation is fast becoming the bigger influence on sentiment.” Read More…