Denmark Real Estate 2022

Trends and Developments

Economic Overview

High inflation, strong growth and increasing interests

This year, inflation in Denmark has been climbing to levels not seen for decades, mainly because of the economic consequences of the Russian invasion of Ukraine and the subsequent western sanctions, combined with the continuing effects of the COVID-19 pandemic.

These tendencies led to further supply-chain disruptions followed by strong growth in the economy due to expansionary economic policies.

These economic scenarios have contributed to the large increases in the interest rates we have seen since the beginning of 2022.

High activity despite reduction of price increases

The climbing interest rates will most likely affect the price of commercial and rental property because of reduced access to financing and higher financing costs.

However, 2021 was the busiest year ever on the Danish market for real estate investments. Price increases reached double digits, mainly due to higher rental income resulting from a high level of economic growth.

These tendencies led to strong demands for commercial leases for offices as well as in logistics and the manufacturing industry.

Activity in the Danish commercial and investment property market remains high in 2022, with significant demands from foreign investors, as has been the case in recent years.

In addition, local investors are continuing to be very active in the market, primarily led by Danish pension funds and several large Nordic property investors who are still actively seeking Danish commercial and investment properties.

High volume of real estate investments is maintained

In recent years, Denmark has seen an increasing number of foreign investors establishing their own local representatives in major cities as Danish real estate is considered a commercial "safe haven".

In these times of turbulence on the financial markets and high inflation, real estate is often seen as an attractive place to invest.

Combined with continuous capital allocations to investments in the Danish commercial and investment property market by Danish pension funds and real estate investment trusts, investment activities are currently at a high level, despite several years of stable growth (apart from the exceptional years of 2019 and 2020).

Security policy risks

Market rumours suggest that investors will start to factor-in security policy risks when assessing real estate investments in Nordic countries in the future.

The consequence will be that Denmark, as a member of NATO, will appear to be a slightly safer haven for foreign investors searching for comparable commercial and investment properties in the Nordic real estate market, as competitor markets, such as Sweden and Finland, are not members of NATO.

Investment Tendencies

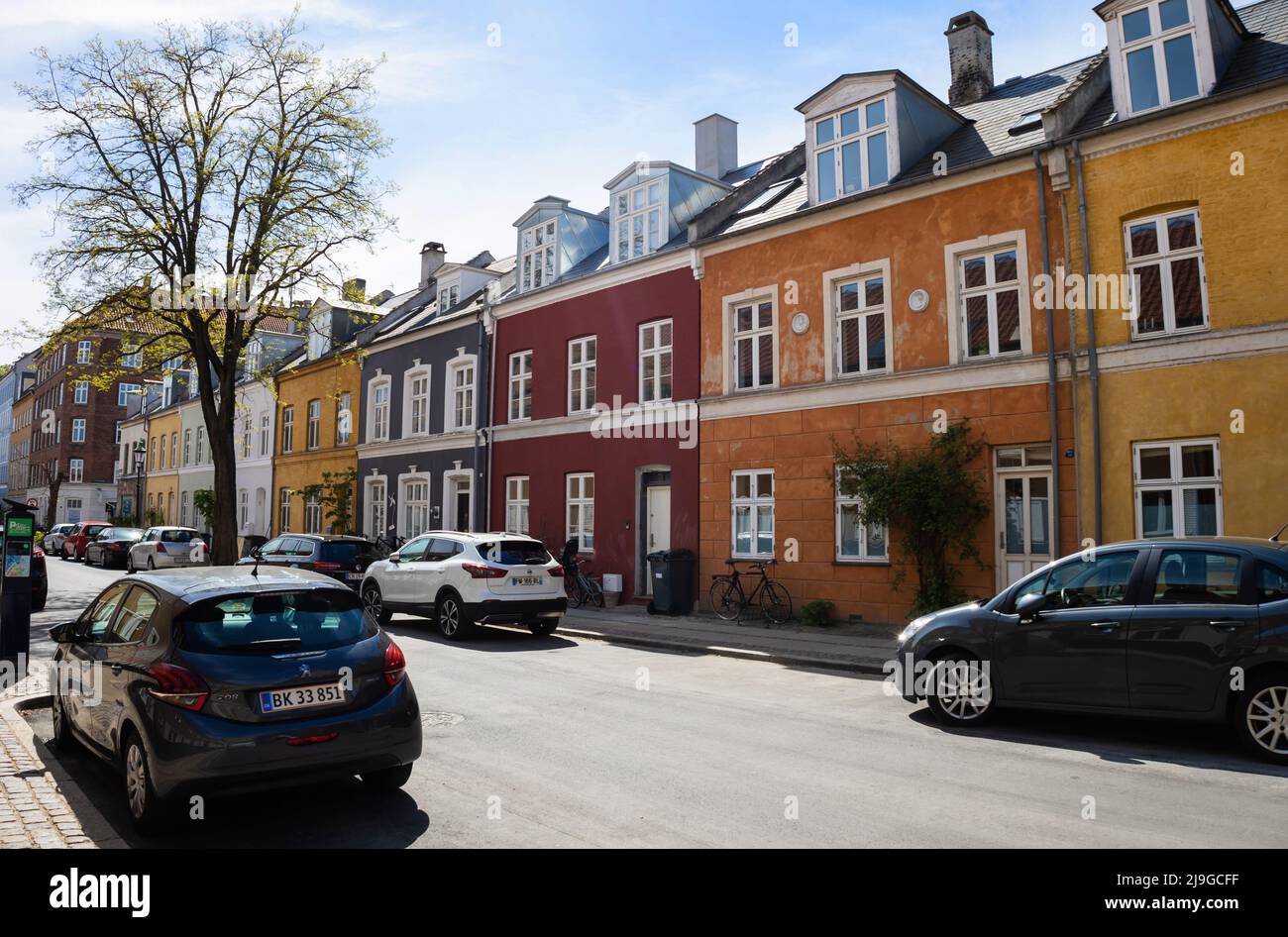

Residential sectors

Residential sectors are likely to remain a popular choice for investor portfolios because there has been continuous growth in large-scale portfolio deals in this sector in the last few years.

A stronger focus from investors on residential property during the COVID-19 pandemic has triggered sales figures and price increases in the residential sector that not many had expected in the early stages of the pandemic. The sales figures and price increases are, in early 2022, moving towards the levels seen just before the pandemic began; however, it is still a seller’s market.

Construction activities remain high within the residential sector in major cities, in order to meet the expected future increase in the population.

Towns near to major cities are also becoming growing investment areas, as investment returns in major cities such as Copenhagen and Aarhus are lower than ever. Read More...