Greece months away from investment-grade rating, says central bank chief

Bank of Greece head Yannis Stournaras adamant 2023 will be the year when the country consigns its junk status to history

Greece is on the cusp of regaining its investment-grade credit rating after 12 years in the junk-bond wilderness, its central bank governor Yannis Stournaras has said as he urged the country’s next government to maintain fiscal prudence.

Stournaras told the Financial Times that he was “confident” that credit rating agencies would upgrade Greek bonds within months, should lawmakers signal their intent to maintain reforms and take advantage of a “window of opportunity” to significantly lower the country’s debt burden.

“We think that 2023 is the year we’ll get the investment grade,” Stournaras said.

His comments come as the country gears up for spring elections, with the incumbent centre-right New Democracy party leading in the polls. The party has signalled that it will continue to carefully manage the public finances.

Stournaras said the most likely timing of the upgrade was “immediately after the election”, but that it could even come before the vote takes place.

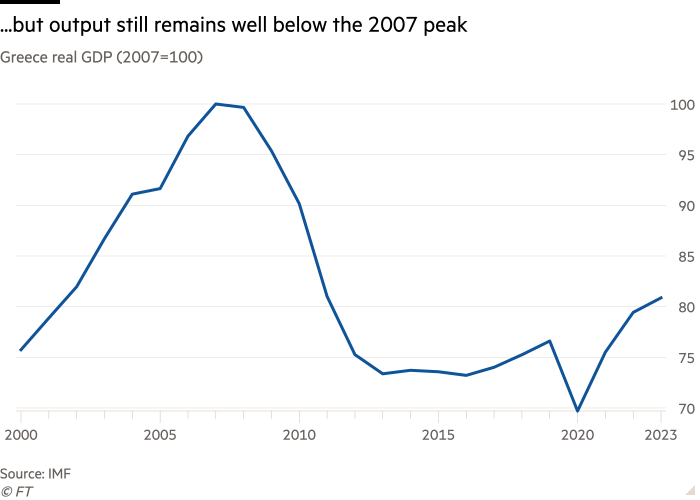

Greece lost its investment-grade status in January 2011 after its economic crisis threatened to break the eurozone apart. Its ratings fell as low as CCC-, before recovering to BB+ — one notch below investment grade — as the country’s economic recovery gathered momentum.

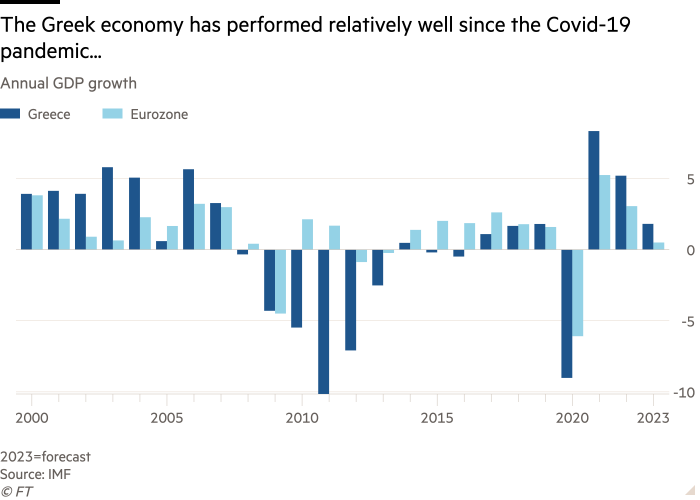

The country managed to shave more than 24 percentage points off its debt-to-GDP ratio last year alone, with its economy expanding by just over 5 per cent over the course of 2022.

“A few years ago, few people expected Greece to remain in the eurozone. Now, not only does it remain, but it performs better than the eurozone average,” the governor said. Read More…