There's a growing interest in wealth taxes on the super-rich. Here's why it hasn't happened

Americans increasingly favor a wealth tax on the ultra-rich. But despite an uptick in proposals, these policies have struggled to gain traction.

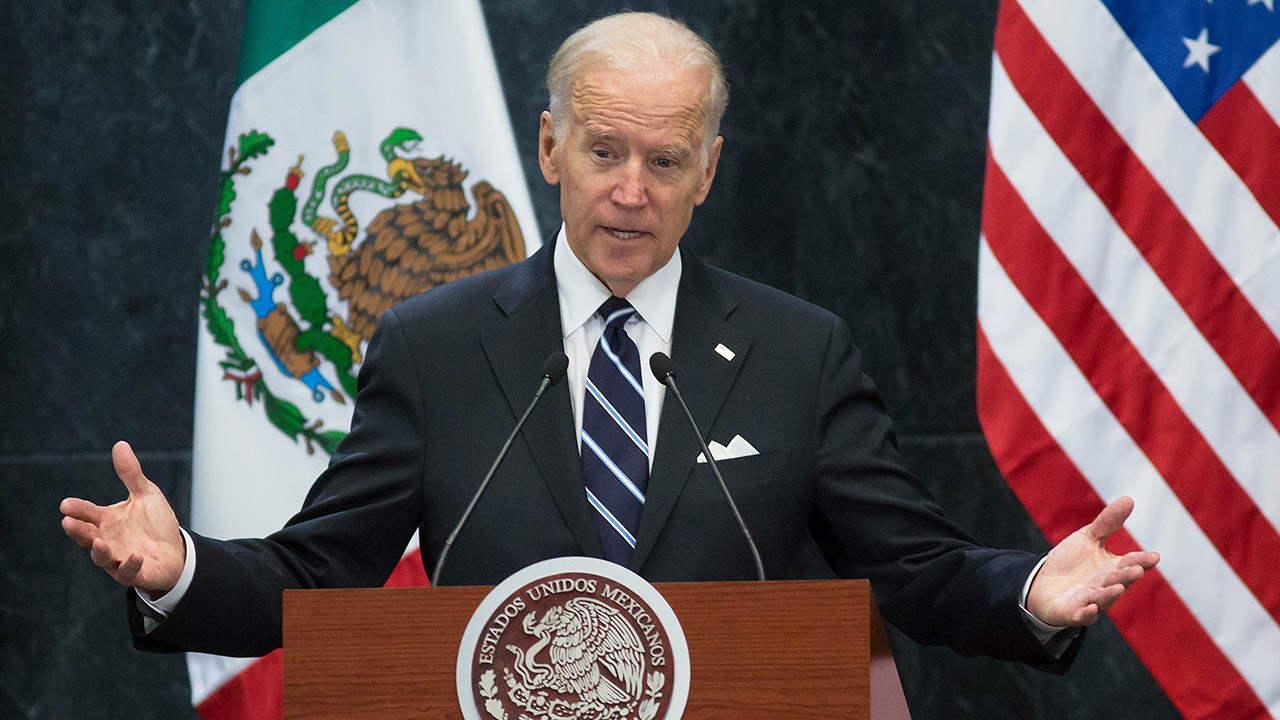

President Joe Biden in March unveiled the latest federal wealth tax proposal as part of his 2023 budget, aiming to reduce the deficit by roughly $360 billion.

Biden’s billionaire minimum income tax calls for a 20% levy on households worth more than $100 million, applying to “total income,” including so-called unrealized capital gains, or asset growth.

However, like previous wealth tax proposals, the plan may struggle to gain broad support, with possible legal issues if enacted, policy experts say.

Wealth tax proposals have emerged in response to growing inequality, according to Steve Rosenthal, senior fellow at the Urban-Brookings Tax Policy Center.

While the federal government previously relied on estate levies to tax wealth, many of the richest households bypass these taxes through sophisticated estate planning strategies, he said.

“We have some fabulously wealthy American households,” Rosenthal said. “But we’re not collecting on that wealth because the estate tax is so porous.”

Moreover, many of the wealthiest families pay relatively low levies on income since the tax code favors earnings from investments, such as interest, dividends, capital gains or rent.

Currently, the top marginal income tax rate is 37%, whereas the highest earners pay 20% for long-term capital gains, plus a 3.8% Obamacare surcharge. Read More...