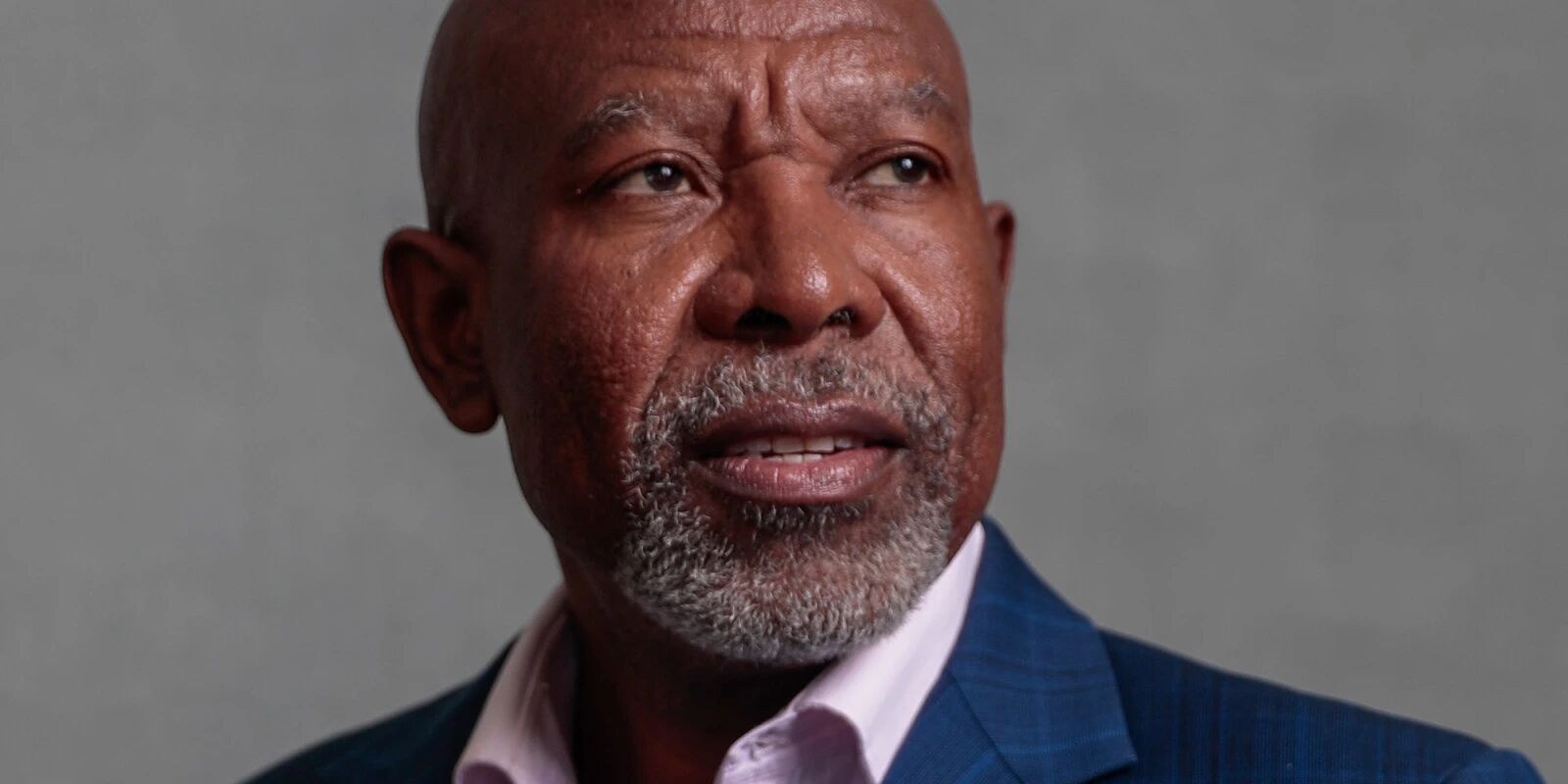

A hawkish SA Reserve Bank continues its tightening cycle and raises rates again

Reserve Bank governor Lesetja Kganyago says the Russia-Ukraine war is likely to reduce global economic growth and contribute to higher inflation. He anticipates that the war will probably impair production of a wide range of energy, food and other commodities, and further disrupt global trade. In line with this, local food price inflation has been revised upwards to 6.1% in 2022 from 4.8% previously, largely on the back of higher global food prices. “While food prices will stay high, fuel price inflation should ease in 2023, helping headline inflation to fall to 4.6%, despite rising core inflation,” he says.

FNB chief executive Jacques Celliers says heightened volatility in equity markets around the world in recent weeks indicates powerful cross-currents at work.

“Inflation, tighter monetary policy and the downstream impact of international conflict are examples of the contributing factors. Despite this, we are seeing a sustained return to improved economic growth in South Africa, driven by higher commodity prices and a return to pre-pandemic conditions. By raising the repo rate, the SA Reserve Bank maintains its growth-friendly stance. The SA Reserve Bank is taking additional steps to combat domestic inflation and to align with higher rates in developed markets,” he says.

Mamello Matikinca-Ngwenya, FNB’s chief economist, says recent upward adjustments to inflation forecasts should place further upward pressure on interest rates, and additional 25 basis points hikes are anticipated at each of the remaining meetings for this year. She notes that South Africa’s economic recovery faces several headwinds from persistent issues such as energy shortages and geopolitical tensions. In addition, consumer and business confidence remain depressed and the labour market is not expected to be very supportive to the recovery. The spike in the cost of living is also widely expected to dent discretionary spending. “Consumer inflation has been lifted by elevated fuel, food and electricity prices – all of which are considered supply-side inflation, which the central bank should theoretically look through. However, a larger proportion of higher input costs could be passed on to consumers and the petrol price shock could further lift inflation expectations. The MPC [Monetary Policy Committee] will continue to be concerned by this, but weaker growth should support a gradual hiking cycle,” she says.

Samuel Seeff, chairman of the Seeff Property Group, says the property market is taking the hiking cycle in its stride and strong activity continues, although homebuyers will most probably have to make adjustments.

As a result of the latest rate hike, and based on a home loan at the base rate over 20 years, homeowners and property buyers will need to budget for increased repayments as follows:

Seeff says at 7.75%, the interest rate is still well below the 10% level of early 2020 before the pandemic and it is generally still cheaper to buy than rent.

Matthew Axelrod, a forex manager at DG Capital Forex, noted that although the 25 basis point interest rate hike was widely expected and priced in, two Monetary Policy Committee members actually voted for a 50 basis point hike.

“The MPC also sounded quite hawkish, talking of inflation approaching the upper end of the target band and, although it revised its GDP growth forecast upwards for 2022 to 2%, it lowered the 2023 and 2024 forecasts to 1.9% for both years, saying it will react accordingly going forward,” he says. Read More…