Bitcoin suffers its worst month ever, while these Web3/DeFi tokens shine out

The value of Bitcoin fell by 38% in June, the worst month since the flagship cryptocurrency became available on exchanges in 2010.

Meanwhile, the world's second-largest cryptocurrency by market capitalization, Ethereum, ended June down 45%.

The crypto market has been wiped out by $2 trillion in a matter of months. However, extreme price volatility is a natural part of the digital asset market. During the last decade, Bitcoin prices went through two extended bear markets. In the previous cryptocurrency winter in 2018, Bitcoin lost over 80% of its value before gaining it back and reaching an all-time high of about $69K in November 2021. Right now, BTC is 71.8% away from this milestone.

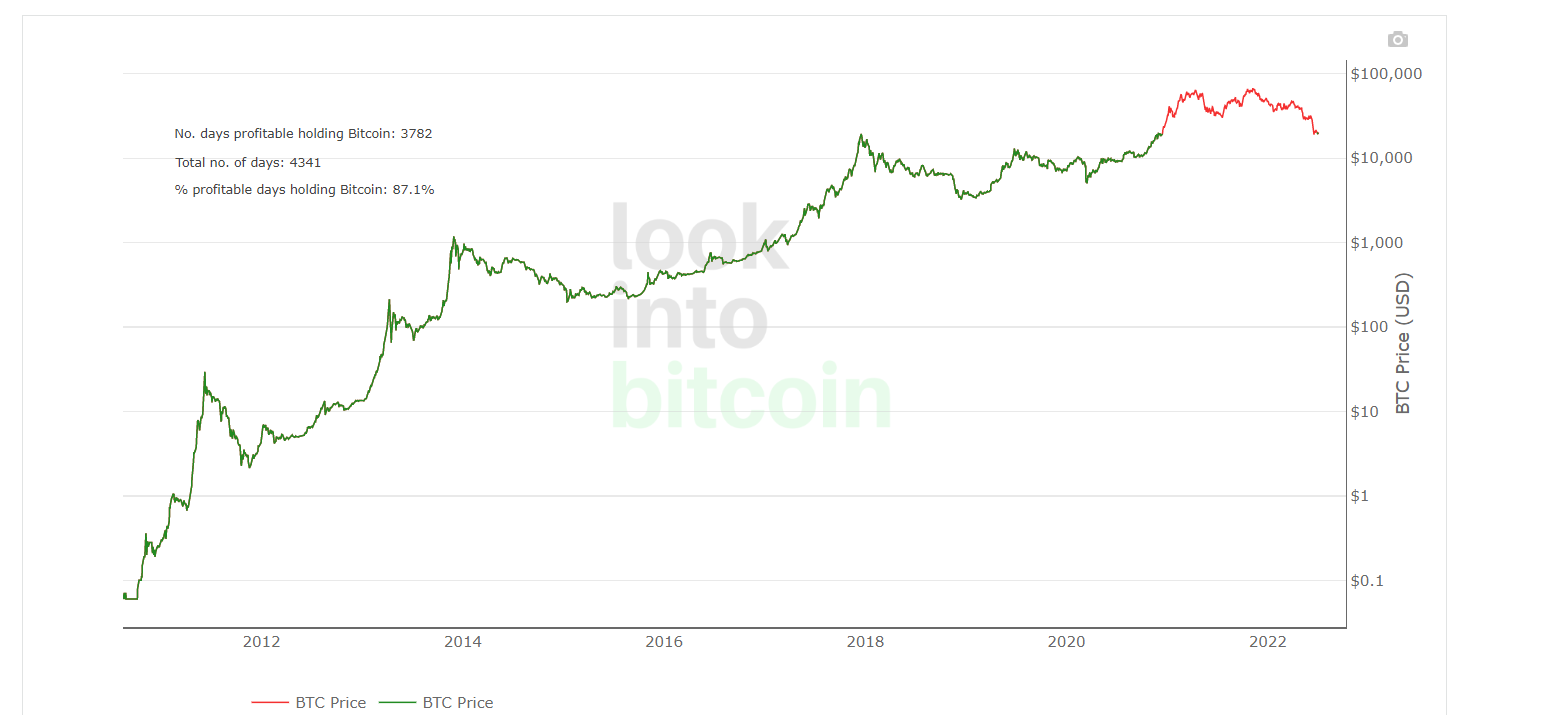

Bitcoin Profitable Days. The number of days in Bitcoin's history when holding it was profitable in comparison to today's price.

This drastic decline has spooked many people, with Bank of America reporting that the number of active crypto users fell by more than half from 1 million in November 2021 to less than 500K in May.

Some, however, view this as an opportunity to stockpile Bitcoin, in memory of its recent triumphant rise. MicroStrategy's Michael Saylor announced that the company had purchased an additional 480 BTC for about $10 million, bringing MicroStrategy's total holdings of Bitcoin to around $4 billion. El Salvador’s President Nayib, who is a huge fan of the number one cryptocurrency, announced that the country’s Bitcoin reserves had been replenished with 80 more bitcoins for a total of $1.52 million, tweeting: "Bitcoin is the future. Thank you for selling cheap.”

Bitcoin Could Be a Hedge Against Monetary Inflation

In spite of once being regarded as a hedge against consumer inflation, which then proved to be wrong, there is a case for Bitcoin to act as a hedge against monetary inflation.

M2 Money supply vs. Bitcoin Price

A monetary aggregate M2 includes all currency in circulation, operational deposits in a central bank, money in current accounts, savings accounts, money market deposits and small certificates of deposit.

During the first half of 2020, the percentage change in the M2 increased rapidly within a short period of time. The percentage change in Bitcoin's price year-over-year followed with a delay. Bitcoin's price hit new heights after the flash crash of that year, and M2 reached new highs as well. Year-over-year growth in M2 peaked at the end of February 2021; the Bitcoin price peaked shortly after in mid-March 2021. In other words, Bitcoin's price has acted as a lagging indicator for M2 money supply in the past two years. In this case, Bitcoin can function as a hedge against monetary inflation.

Bitcoin Is No longer the Most Popular Blockchain

As the Chainalysis report charts the number of unique wallets sending each currency to services over time, it appears that Bitcoin led in terms of unique users until March 2020, when Ethereum surpassed it. It's logical that this growth corresponds with DeFi's growth, as the rise of DeFi led to the creation of many services that accept Ethereum and other tokens built on its blockchain. Read More...