Central bank mulls real-estate curbs

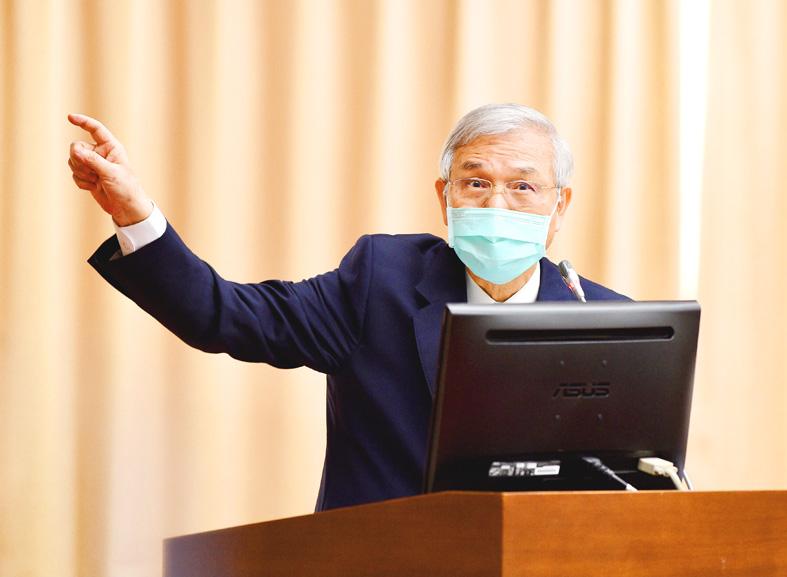

Central bank Governor Yang Chin-long (楊金é¾) yesterday said there is still room for credit tightening to cool metropolitan Taipei’s property market, adding that mortgage restrictions for those buying a second property are potential options.

Yang’s statements came at a question-and-answer session at the legislature in Taipei focused on potential economic repercussions from the US Federal Reserve’s expected interest rate increases and inflation pressure caused by Russia’s invasion of Ukraine.

“There is still room for the central bank to improve its policy measures to cool down the property fever,” Yang told lawmakers on the Finance Committee, after some of them had called existing credit controls ineffective.

Lawmakers said that Taiwan should learn a lesson from South Korea, where real estate becoming increasingly unaffordable led to the opposition candidate winning Wednesday’s presidential election.

Yang said that second-home mortgage restrictions imposed in 2010 proved successful to curb housing price increases in metropolitan Taipei.

Reimposing the measure would be discussed at the central bank’s quarterly policy meeting on Thursday next week, he added.

Housing prices surged due in part to Taiwan’s strong economy, Yang said, denying that fund inflows and property speculation are the main factors.

The central bank is seeking to induce a soft landing for housing prices, Yang said.

Measures to rein in the housing market should not be used to fight inflation, as they would prove costly after interest rates have been raised, he said.

Yang said he doubted that Russia would soon be bankrupt due to economic sanctions, including oil embargos and its credit ratings being downgraded. Read More...