Current account deficit to treble

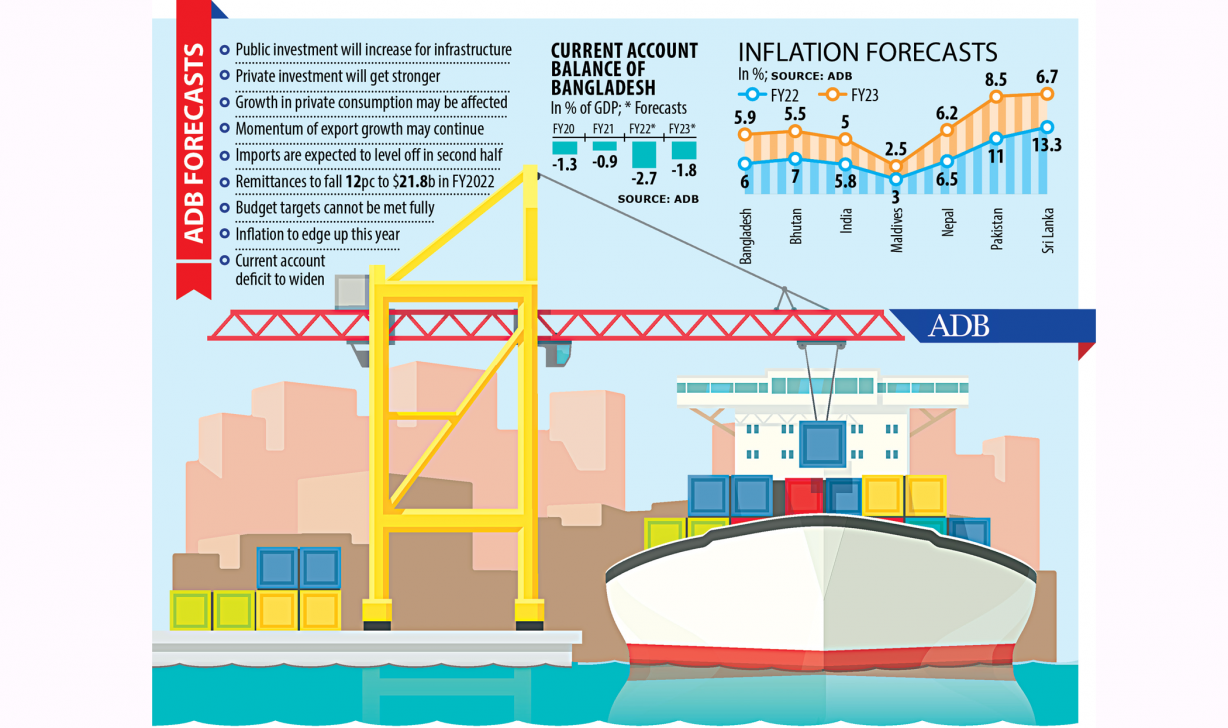

The current account deficit in Bangladesh is expected to widen to 2.7 per cent of gross domestic product (GDP) in the current fiscal year from 0.9 per cent a year ago because of escalating imports and a decline in remittance.

The deficit, which indicates a shortfall between the money received by selling products to other countries and the money spent to buy goods and services from other nations, is double the FY2020 level, according to the Asian Development Bank (ADB).

It is, however, forecast to narrow to 1.8 per cent of GDP in FY2023, aided by a rebound in remittances and slower import growth.

The forecast was made in the Manila-based development lender's annual flagship publication -- Asian development Outlook 2022 --published yesterday.

Bangladesh's current account deficit hit an all-time high of $10 billion in the first seven months of the ongoing fiscal year due to the escalation of the trade deficit and slower-than-expected flow of remittances.

The previous highest deficit in the current account was $9.56 billion in FY18, data from Bangladesh Bank showed. The deficit was $4.57 billion last fiscal year.

Import payments rose by 46 per cent in the July-January period of FY22 after contracting 0.2 per cent in the same period in the last fiscal year as the economy is roaring back to normalcy thanks to the receding pandemic.

Half of the imports of intermediates went to the garment industry and the rest to other manufacturing. Imports of food grains and other basic consumer goods increased by a combined 55.3 per cent and imports of capital goods expanded by 46 per cent, reflecting improving business confidence, the ADB said.

"With inventories replenished, imports are expected to level off in second half."

The import growth for the whole of FY22 is forecast at 24.3 per cent. It is expected to slow on a higher base, easing global oil and other commodity prices, and lower food imports on an uptick in agriculture.

Remittance is forecast to fall to $21.8 billion in the current fiscal year, down 12 per cent in FY2021, reflecting a high base and greater use of unofficial channels by remittance senders.

"Lower remittance in FY2022 will affect the current account deficit," the report noted.

Remittance, however, rose to an eight-month high in March as migrant workers sent home a higher amount to help their families meet an increased expenditure during Ramadan, Bangladesh Bank data showed.

The receipts in FY23 are projected to rebound to $23.3 billion, up 6.8 per cent, riding on an additional 0.5 percentage points increase in the cash incentive and increased government efforts to curb the use of unofficial channels take hold.

The ADB has forecast Bangladesh's GDP to continue to maintain a strong growth of 6.9 per cent in FY22.

Calling the fallout on the global economy from the Russian invasion of Ukraine the main uncertainty, the report stated that higher prices for oil and imports, and loss of export sales beyond those built in the present forecasts, are the key risks to the outlook.

Inflation is expected to increase to 6 per cent in FY22 from 5.6 per cent in FY21 as price pressures are increasing from the upward adjustment in domestic administered fuel prices, rising global food and fuel prices, and the implementation of stimulus measures.

Monetary policy is expected to continue to be accommodative and expansionary in FY22 while containing inflation and maintaining financial stability.

The price adjustments for liquefied petroleum gas or liquefied natural gas in the coming months may also intensify inflationary pressures, said ADB Country Director Edimon Ginting at a virtual press conference after the launch of the report.

Ginting suggested a few key steps to sustain the higher growth trajectory over the medium and long-term and make it more inclusive.

"Efforts are needed to boost competitiveness, employment, and private sector development while regulatory bottlenecks need to be reduced. Critical infrastructures need to be built to improve the efficiency of the domestic value chain." Read More...