Intel and LG Bypass Vietnam for Billion-Dollar Projects

Foreign corporations such as Samsung, Intel, and LG have recently surveyed Vietnam for potential investments but ultimately decided to invest their billion-dollar projects in other countries. This trend was highlighted in a report by the Ministry of Planning and Investment (MPI) concerning the establishment, management, and utilization of the Investment Support Fund.

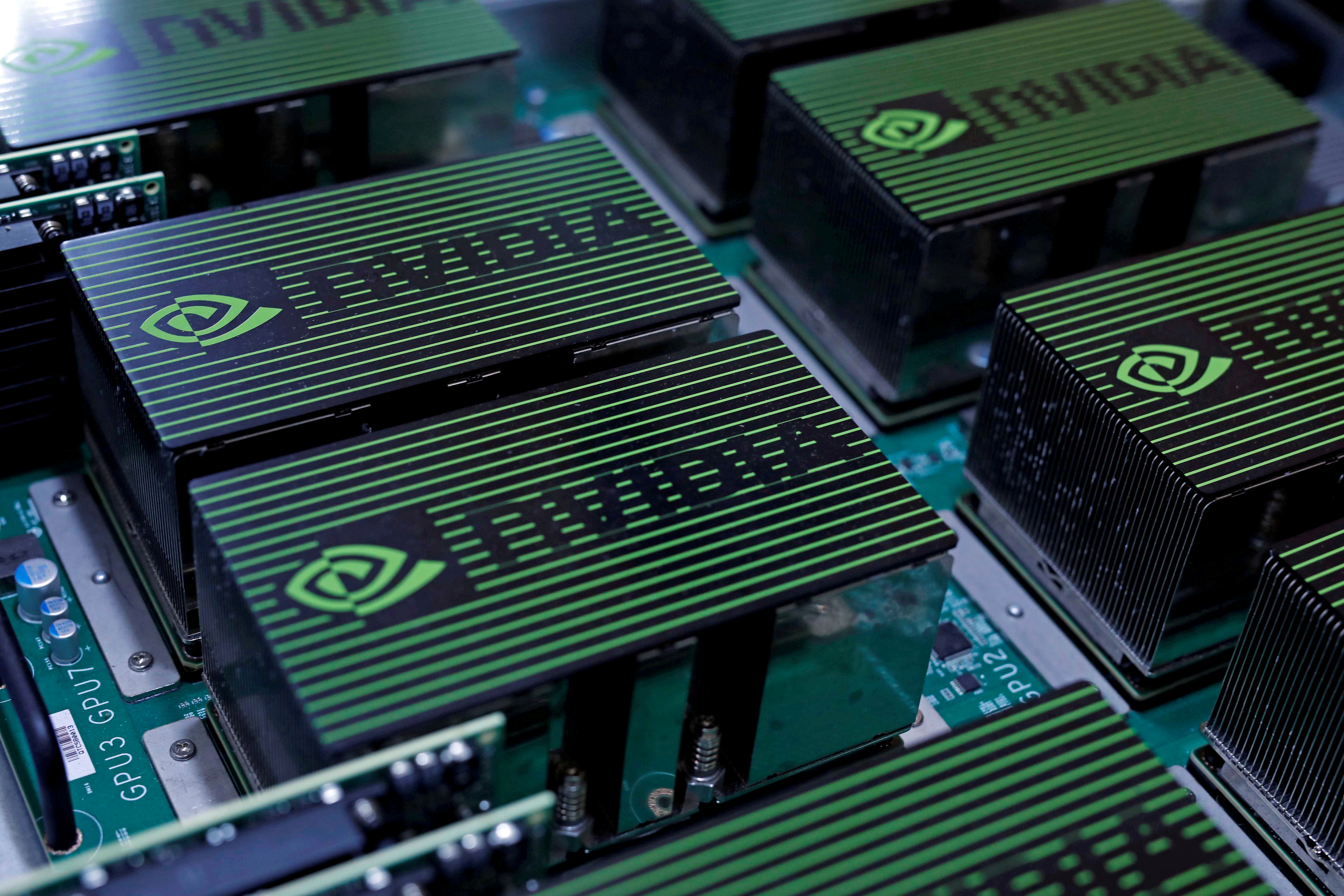

According to the MPI, many countries are actively attracting high-tech investments in areas such as semiconductors, artificial intelligence (AI), and chip production, which are currently global trends. Countries like the United States, South Korea, India, China, and various European nations, as well as neighboring countries like Singapore, Malaysia, Indonesia, and Thailand, offer diverse and attractive incentives. These incentives include both income-based benefits (tax exemptions and reductions) and cost-based incentives, with support packages reaching billions of dollars.

Due to swift policy reforms, these countries, especially Southeast Asian neighbors, have successfully attracted significant high-tech projects. Conversely, despite a steady increase in foreign investment, Vietnam has seen a modest number of large-scale high-tech investment projects. The expansion of some high-tech projects in Vietnam has shown signs of stagnation. Companies like LG, Samsung, and Intel have announced halts in their new investment plans or expansions in Vietnam. Additionally, several large corporations have surveyed and studied investment opportunities but have opted for other countries or are waiting to see Vietnam's policy responses.

Notable cases include:

- LG Chemical proposed a battery production project requesting 30% cost support from Vietnam but later moved to Indonesia.

- Intel proposed a $3.3 billion chip production project, asking for 15% cash support, but ultimately chose Poland.

- Austrian semiconductor company AT&S surveyed Vietnam but decided on Malaysia due to unmet support requirements and a lack of available high-tech labor.

Furthermore, several large-scale high-tech projects are on hold, awaiting new policies from Vietnam. For example, Samsung plans to shift production lines to India, LG has paused a $5 billion electronic device production investment, and SMC (Japan) is considering a $500 million to $1 billion investment in Dong Nai province.

In light of these developments, the MPI suggests that Vietnam needs to implement breakthrough and selective investment support policies to maintain its competitive position. This is crucial to retain and attract leading corporations with extensive supply chains and substantial socio-economic impacts. These policies are not intended to compensate investors within the scope of the global minimum tax but to encourage all businesses meeting priority investment criteria, demonstrating the Vietnamese government's commitment to partnering with investors amid changing international circumstances.