Options Markets More Bullish on Bitcoin Than Ethereum – What This Means for ETH/BTC

Investors are more bullish on Bitcoin than they are on Ether (ETH) over the next few months, according to various option market gauges of sentiment provided by crypto analytics website The Block. That could mean downside for the ETH/BTC exchange rate over the next few weeks and months.

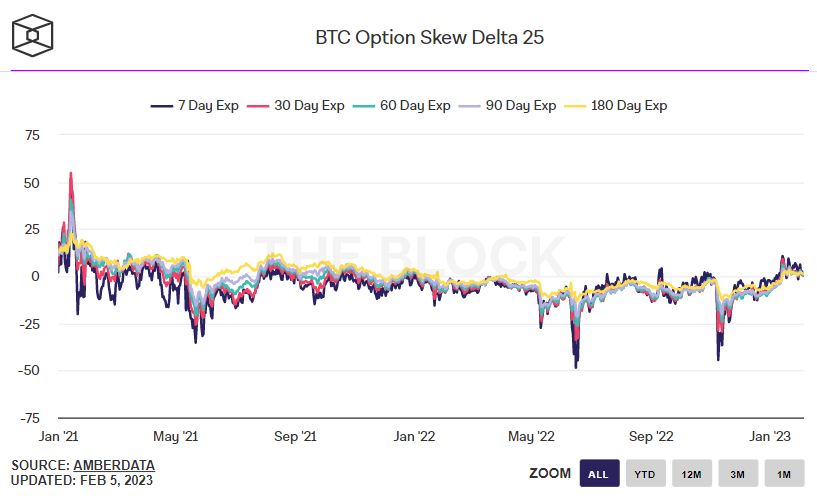

According to a chart provided by The Block, the widely followed 25% delta skew of Bitcoin options expiring in 180 days remained was 1.32 on the 5th of February, not too far below recent one-year highs hit last month in the 3.3 area. The 25% delta skew of Bitcoin options expiring in 7, 30, 60, 90 days were all a little lower, but still above zero, hence indicating that the market has a modestly positive bias.

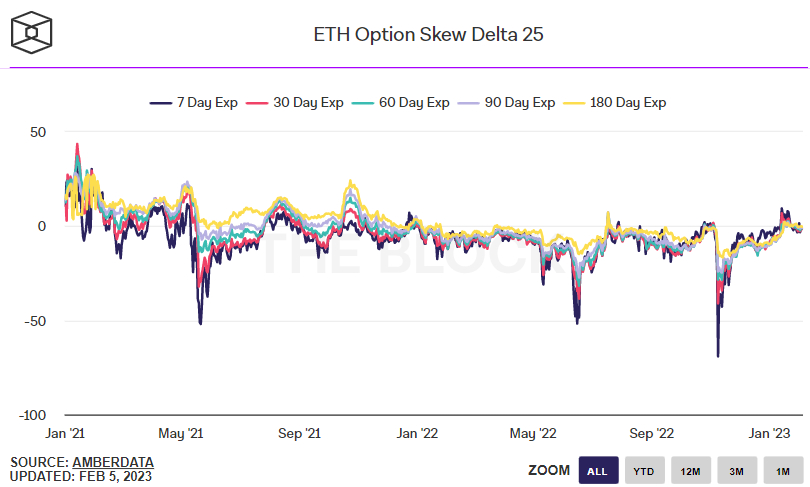

The 25% delta options skew is a popularly monitored proxy for the degree to which trading desks are over or undercharging for upside or downside protection via the put and call options they are selling to investors. Put options give an investor the right but not the obligation to sell an asset at a predetermined price, while a call option gives an investor the right but not the obligation to buy an asset at a predetermined price.

A 25% delta options skew above 0 suggests that desks are charging more for equivalent call options versus puts. This implies there is higher demand for calls versus puts, which can be interpreted as a bullish sign as investors are more eager to secure protection against (or bet on) a rise in prices.

The 25% delta skew of Ether options expiring in 180 days, meanwhile, was -0.3 on the 5th of February, while the 25% delta skew of Ether options expiring in 7, 30, 60, 90 days were all a little lower at between -0.8 and -1.5. Options markets thus indicate that investors currently have a modestly negative bias on ETH.

Put/Call Ratio Also Concerning For Ethereum Bulls

The ratio between the open interest of Bitcoin put and call options was 0.39 on the 4th of February, close to its lowest in over two years. A ratio below 1 means that investors favor owning call options (bets on the price rising) over put options (bets on the price dropping). Read More…